The YouthCred initiative has officially launched its innovative credit program aimed at supporting young Nigerian entrepreneurs. The program debuted at an event held at the Abuja NYSC orientation camp on Thursday, was organized in partnership with Credicorp and attended by key government figures including the Minister of Youth Development.

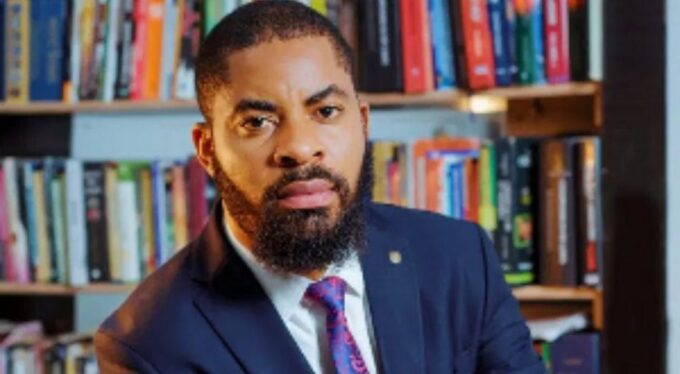

During the launch ceremony, the Minister urged Nigerian youth to embrace entrepreneurship opportunities, stating that initiatives like YouthCred provide vital pathways to financial independence and business growth.

He specifically encouraged young Nigerians to “leverage the opportunity brought by YouthCred to develop their future.”

NYSC Director General Brigadier General O. O. Nafi’u echoed this sentiment, expressing his belief that “the launch of YouthCred will empower vibrant youths and provide corpers with support to achieve their goals.”

YouthCred has formed a groundbreaking alliance with CrediCorp, Nigeria’s Consumer Credit Corporation, to revolutionize financial access for young Nigerians. This partnership tackles the nation’s credit access challenges through a comprehensive approach that combines financial education with practical credit-building opportunities.

The collaboration specifically addresses the barriers that have traditionally prevented Nigerian youth from establishing credit histories and accessing affordable financing options.

The YouthCred program features specialized financial products tailored to different segments of Nigerian youth. The Corper Credit provides NYSC members with accessible short-term financing, while the YouthCred Card offers young professionals flexible credit with extended 12-month repayment terms.

The initiative presents a natural partnership opportunity with the National Youth Service Corps, aligning perfectly with NYSC’s mission of youth development and national unity.

YouthCred represents a transformative shift in Nigeria’s financial landscape, equipping the next generation with the tools to build creditworthiness and achieve financial stability. By combining education with accessible credit products, the program aims to foster a new culture of financial responsibility while unlocking the economic potential of Nigeria’s youth population.

The initiative stands as an open invitation to all young Nigerians to harness these resources for personal advancement and contribute to the nation’s broader economic growth.

Leave a comment